Gold 🪙 & Currency 💲💵 Live Chart Provider in Amibroker Gold 4hour Chart : 3280.49…

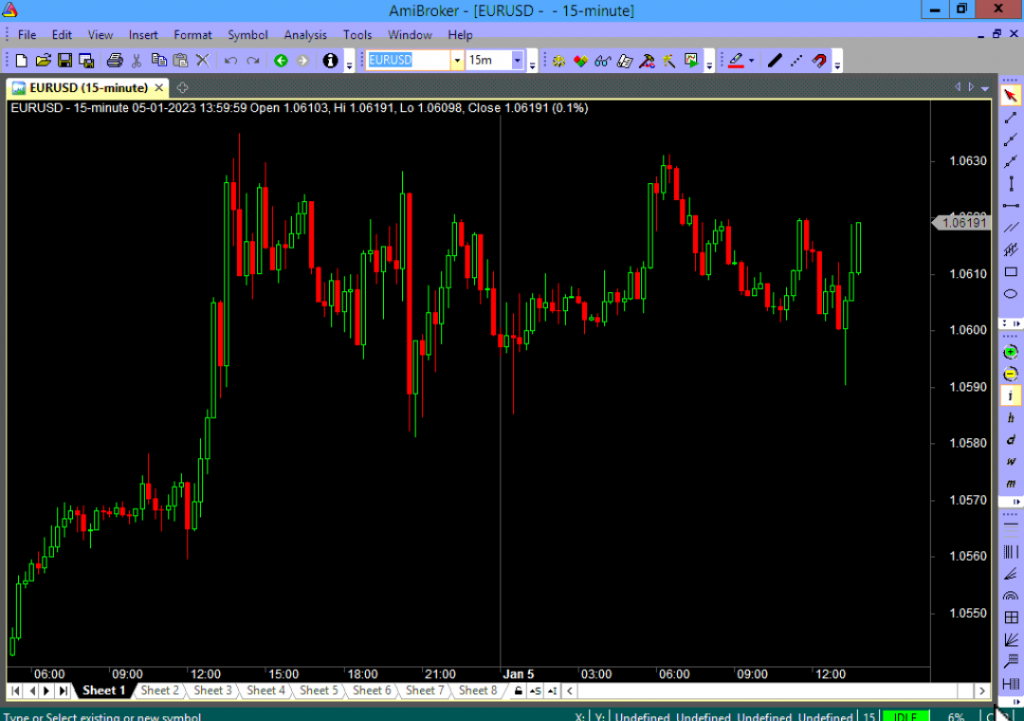

Iwinchart : Trading in Eurusd

Trading the EUR/USD currency pair involves buying or selling the Euro (EUR) against the US Dollar (USD). The value of the currency pair is determined by the supply and demand for each currency, as well as a range of economic, political, and market factors that can influence the exchange rate between the two currencies.

There are several ways to trade the EUR/USD currency pair, including:

Spot forex: This is the most common way to trade the EUR/USD, and it involves buying or selling the currency pair at the current market price.

Forward contracts: A forward contract allows you to lock in a specific exchange rate for a currency pair at a future date. This can be useful if you expect the value of the currency pair to change significantly in the future.

Options: An option is a financial contract that gives you the right, but not the obligation, to buy or sell a currency pair at a specific price on or before a certain date.

CFDs: A CFD (contract for difference) is a type of derivative product that allows you to speculate on the price movements of the EUR/USD without actually owning the underlying currency pair.

It’s important to carefully consider your investment objectives and risk tolerance before deciding on a trading strategy for the EUR/USD currency pair. It’s also a good idea to educate yourself about the markets and to seek the advice of a financial advisor or professional before making any trades.